image:PA

The slowdown in the global tech sector poses a risk to soaring corporate tax receipts in Ireland next year and, in particular, in 2024, chief economist at the Department of Finance John McCarthy has warned.

Corporate receipts, mainly paid by a small number of large multinational companies whose European headquarters are based in Ireland, have risen by more than 400 per cent in the last 10 years to account for a quarter of the State's entire annual tax take.

Mr McCarthy said corporate taxes could reach €22 billion this year, above the €21 billion forecast two months ago.

Speaking before the Public Accounts Committee on Thursday, Mr McCarthy said he was "more worried" about later years, especially if there is a shock to the Information and Communications Technology (ICT) sector.

Although we did the budget (in September), Mr. McCarthy said, "I think it's fair to say the correction in the industry has maybe been a little bit sharper than we might have imagined." We do have a slowdown in the ICT sector built into our estimates, he added.

"Depending on how the sectors develop, there is undoubtedly a risk to 2023 and, more likely, the corporation tax number in 2024."

Multinational corporations, which employ over 275,000 people, or one in nine workers, are incredibly important to the State.

In the first half of 2022, employment growth in foreign-owned businesses, which includes other significant industries like biopharma, medtech, and financial services, reached record highs.

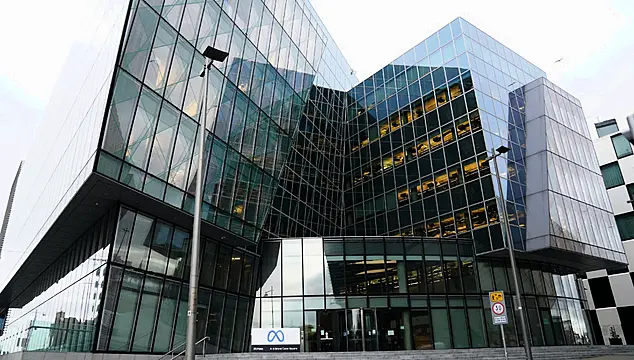

However, as a result of worldwide cost-cutting measures, a number of internet firms, including Twitter, Facebook's parent company Meta, and digital payment provider Stripe, have since laid off Irish employees.

John Hogan, the Department of Finance's secretary general, stated that he thought the tech cuts were a "realignment" following a period of strong expansion.

Mr. McCarthy pointed out that when the income tax of their highly compensated staff is taken into account, just 10 corporations contribute for 36% of all taxes paid in the nation, demonstrating how vulnerable the public finances are to a more severe multinational shock.

As a result of the increase in corporate taxes, the State's budget returned to a modest surplus this year. It is anticipated that the surplus will increase to 2.2% of gross domestic product next year, enabling the State to set aside €6 billion in corporate receipts for the National Reserve or "Rainy Day" Fund.

READ ALSO:

🔘IRELAND: "Prison sentence of up to 8 years"; Gambling Control Bill; Ireland for gambling regulation

🔘Extension of the short term visiting visa for parents of non European workers in Ireland

.png)

The opinions posted here do not belong to 🔰www.indiansdaily.com. The author is solely responsible for the opinions.

As per the IT policy of the Central Government, insults against an individual, community, religion or country, defamatory and inflammatory remarks, obscene and vulgar language are punishable offenses. Legal action will be taken for such expressions of opinion.